Could the potential “once in a lifetime” storm blow out your portfolio?

Probably not, suggests our call of the day, from CFRA’s Sam Stovall.

“History says that hurricanes typically don’t trigger broad market declines,” the chief investment strategist writes in a note.

“During the 15 most expensive hurricanes, the S&P 500 declined by 0.2% the month after the hurricane formed, and was 3.9% higher in the subsequent three months. Of course, there is no guarantee that history will repeat itself.”

As Hurricane Florence bears down on the Carolinas, it has been downgraded to a category two storm. Still, it remains powerful and deadly, packing 110-mph winds. Stovall notes “a potential storm surge of up to 50 miles inland” could wreak havoc.

Who can forget that massive wall of water that caused so much devastation as Hurricane Katrina hit in 2005?

CoreLogic estimates that the property damage from Florence could top $170 billion, Stovall also points out. That would exceed Katrina’s corresponding figure of $161 billion.

And the CFRA strategist highlights how sectors are making moves: “Home improvement and building supply stocks are moving higher, as airline and insurance stocks move lower.”

Among the insurers feeling pressure are Travelers TRV, +1.53% , Allstate ALL, +1.51% , Chubb CB, +1.20% and Berkshire Hathaway BRK.A, -0.24% BRK.B, +0.14% , according to J.P. Morgan. And restaurant stocks like Cracker Barrel CBRL, +0.12% are also in the firing line.

On the other side, companies that offer goods and services needed in the run-up and aftermath of a storm may fare well, such as Home Depot HD, -1.19% Thor Industries THO, -0.23% , Avis CAR, -1.34% and United Rentals URI, -0.15% to name a few. Check out more companies that could get bumped higher here.

The market

The S&P SPX, +0.53% , Dow DJIA, +0.57% and Nasdaq COMP, +0.75% are all moving higher in the early going.

Gold GCU8, -0.39% is up, while crude US:CLU8 is down after the IEA said OPEC oil production shot up last month. The dollar DXY, -0.01% is firming up.

Europe SXXP, -0.15% is mostly higher, after Asian markets ADOW, +0.90% bounced back.

The chart

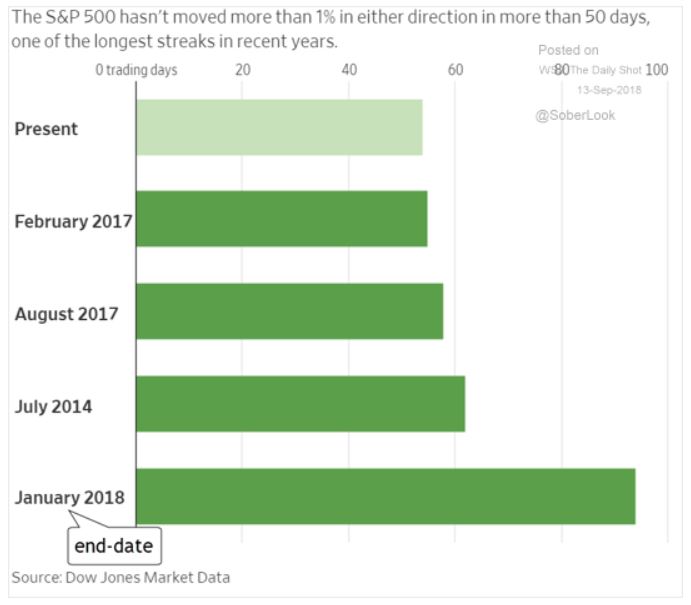

Inexplicably bored by U.S. markets?

It isn’t all in your head, says our chart of the day.

The S&P 500 has been stuck in a “low-volatility regime” since the summer, according to this Wall Street Journal report that features the below chart. The index hasn’t moved more than 1% in either direction in more than 50 days:

The buzz

The Bank of England, European Central Bank and Turkey’s central bank all are making policy decisions today. The BOE stood pat, as expected, along with the ECB, while Turkey’s institution hiked rates, rallying the battered lira USDTRY, +0.6446% . A presser from ECB Pres. Mario Draghi has also been grabbing attention too.

Turkey’s Recep Tayyip Erdogan did the lira TRYUSD, -0.6404% no favors this morning by calling for interest rate cuts. He also announced moves to prop up the lira by banning domestic sales in foreign currencies

SurveyMonkey parent SVMK SVMK, +0.00% plans to offer 13.5 million shares priced at $9 to $11 a pop for its Nasdaq debut. Meanwhile, China online services provider Meituan Dianping reportedly raised a whopping $4.2 billion from its Hong Kong IPO, priced near the top of its projected range.

On the trade front, the White House has invited China to another round of talks later this month aimed at averting fresh tariffs on $200 billion in Chinese exports.

AT&T T, +0.78% has a plan to compete with Netflix NFLX, -0.49% , and it includes shifting more resources to HBO.

On the economic front, jobless claims fell slightly and consumer inflation rose again in August. The federal budget and a speech from Atlanta Fed President Raphael Bostic are also coming our way.