You may be earning money over the summer from an internship, job or any other form of employment. If you’re making some bank this summer, remember that fall semester is approaching faster than we think, and as college kids we always need money.

We need textbook money, emergency money, rent money and, of course, some cash to put into our emergency coffee fund. Saving money can be hard as a college student because we do have a plethora of expenses, but here are some easy ways to save our summer cash for the upcoming semester.

Even though there are only about eight more weeks in the summer, it is never too late to start saving for what’s ahead or for a rainy day.

Put away $20 a week.

This method only puts you at about $160 in the end of the remaining eight weeks of summer, which can be used as coffee money for the semester or an emergency ride home fund if needed. That $160 can also finance half of a textbook or one without a cover and stains on the pages if you purchase a used book.

This method is best for people who have a lot of expenses during the summer months like gas, rent and other necessities.

Get another small job or increase your hours at your current job.

We know what you’re thinking: We are still recovering from spring semester finals and it seems as if our brains never get a break from work.

However, it may be in your best interest to obtain a small side job such as babysitting, landscaping or whatever small gig floats your boat to supplement your primary income. The small job could be for your savings money or spending money, and your primary form of employment could be used for your major expenses or whatever you please.

“As a rule of thumb, it is best to spend about 10 percent or less per paycheck on fun things — a night out to eat with friends for example.”

More money made means more money that you have to save, but if you do not want another job even if it is small, that is OK. You could always try to obtain more hours at your current job by having a professional conversation with your boss.

Monitor your current spending.

This one is a no-brainer, because we should always be watching the cash flow both to and from our wallets at all times.

It may come as a surprise, however, that we spend more in the summertime than we do during the semester on small expenses. Let’s face it — we are home, on campus or abroad during the summer and we want to go out to eat, go on adventures or spend money on our family vacations.

Some of us let that spending get out of hand, and it is important to compare how much you are spending on small expenses to your necessities. As a rule of thumb, it is best to spend about 10 percent or less per paycheck on fun things — a night out to eat with friends for example. So if you make $300 per paycheck, spend no more than $30 on going out to eat with your friends or on any other leisurely activities between paychecks. You would be surprised at how much of a difference this cutback can make.

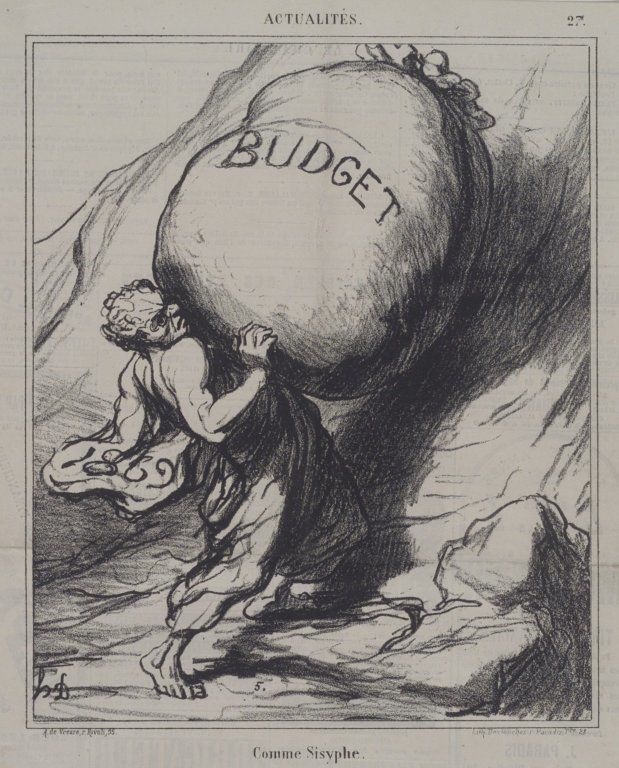

Cut some things out of your budget.

Constructing a budget for the weeks ahead or one week at a time is something that have found to be extremely helpful when it comes to saving money. Budgets allow you to cut your unnecessary expenses and know how much you will need to make in paychecks to keep yourself afloat.

All in all, planning ahead and sticking to a savings routine will help us all have some bacon for the semester or semesters ahead.