Oil prices have rebounded well off of their 2016 lows and now appear to have stabilized in the $60-plus per barrel range. However, while some energy stocks have similarly recovered, others remain deeply out of favor with the market — which presents an opportunity for investors. In addition to a value price, ExxonMobil Corp. (NYSE:XOM) and Buckeye Partners, L.P. (NYSE:BPL) also bring high dividend yields to the table. They are both worth a deep dive today.

The conservative giant turns

ExxonMobil is one of the world’s largest integrated energy giants. It produces oil and natural gas on the upstream side of its business and chemicals and refined products on the downstream side. This helps to even out its performance when energy prices are volatile — a fairly common condition. This balanced model also speaks to the highly conservative culture of the energy giant, which is further highlighted by its impressive 36-year streak of annual dividend increases and its low debt level. (Long-term debt is just 10% of the capital structure.)

IMAGE SOURCE: GETTY IMAGES

That conservatism, however, can leave it flat-footed when markets are moving quickly. That’s exactly what’s happening right now. ExxonMobil started pulling back on capital spending during the deep oil downturn that started in mid-2014, and has been late to hit the accelerator now that crude prices have recovered. For example, first-quarter earnings were up roughly 15% year over year, but many of its integrated peers have been doing better. For example, Royal Dutch Shell, which made a huge acquisition during the downturn, saw Q1 earnings advance nearly 63%.

Another key problem is that ExxonMobil’s production has been weak: It fell slightly in each of the last two years, and did so again, year over year, in Q1. Recently, the Motley Fool’s Tyler Crowe described Exxon as “testing” its investors — and that situation isn’t likely to end for a couple of years, as the company’s large growth projects aren’t expected to add materially to its revenues or profits until 2020. In the meantime, investors get to watch capital spending rise with little return on that investment.

XOM PRICE TO TANGIBLE BOOK VALUE DATA BY YCHARTS

It’s no wonder, then, that ExxonMobil’s dividend yield is on the high side of its historical range at around 4%. And the company’s tangible book value is lower than it has been since the late 1980s. Don’t expect a quick turnaround, either, as large projects in Guyana, Brazil, and Mozambique, among other locations, will take time to develop. But once they are up and running — they’ll account for roughly half of the energy giant’s upstream earnings by 2025 — investors will likely reward ExxonMobil stock with a higher valuation. It is also working on large new downstream projects that will help to boost results, but they too are a few years from completion.

While these long-term plans play out, however, patient investors can collect large yields backed by a growing dividend at a conservative energy company. That’s a worthwhile trade-off in my opinion.

A bit more risk if you can handle it

Buckeye Partners is a relatively small midstream energy limited partnership, and a more aggressive play for investors. The partnership’s core assets are pipelines and storage. It differentiates itself from many of its peers because it has a truly international presence, with storage assets located in the Caribbean, Europe, Asia, and the Middle East. The problem is that Buckeye’s distribution coverage ratio has been notably weak, falling to just 1 in 2017. Investors are worried that the partnership’s current round of capital spending will compel it to cut the distribution.

That’s not an unreasonable expectation. However, management has steadfastly continued to assert that it will support the dividend. As recently as June 5, they stated: “Given our current outlook, we have no intentions of cutting Buckeye’s distribution.” And a cut would likely be a last-resort move, given that the partnership has increased its distribution annually for 22 consecutive years. Moreover, management has taken the long view before, letting the coverage ratio fall below 1 in 2013 and 2014 while it waited for investments to bear fruit.

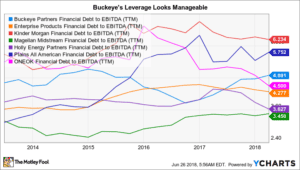

BPL FINANCIAL DEBT TO EBITDA (TTM) DATA BY YCHARTS

The partnership is also fairly conservative financially, with a debt-to-EBITDA ratio of around 4.9, which isn’t particularly out of line with its midstream peers or its own history. However, the fear of a distribution cut is a big headwind in an asset class that’s specifically designed to push income through to unit holders, which is why Buckeye’s distribution yield is a massive 14% today.

The partnership doesn’t expect to issue any new units through the end of 2019, which would make it even harder to cover distributions. Although the recent use of hybrid debt and issuance of a new class of units that have a payment in kind distribution (which temporarily allows the partnership to avoid cash distributions on the units) suggests Buckeye is getting aggressive in order to raise non-dilutive cash, management believes that it still has plenty of financing options available should it need additional funds. Buckeye is openly calling 2018 a transition year, with major projects, like expansions in Texas, Chicago, and Michigan/Ohio, not expected to add materially to the top or bottom lines until 2019 or 2020.

If you can take the long view along with management, Buckeye’s huge yield is worth the risk for investors who can handle a little uncertainty. When coverage picks back up, the market is likely to push the unit price higher.

High yield options for your shortlist

Exxon and Buckeye have very different investment profiles: One’s a large and conservative company, and the other’s relatively small, but willing to take some short-term risks to grow its business. Exxon, with its roughly 4% yield, is a good option for investors looking for a safe investment that’s out of favor. Buckeye is appropriate for more aggressive types willing to handle the uncertainty of weak distribution coverage today in exchange for a huge 14% yield, and plans that should fix the company’s issues starting in 2019.