Saving for retirement is an extremely sensitive subject with people in their 30s — just look at the response to my article on the matter.

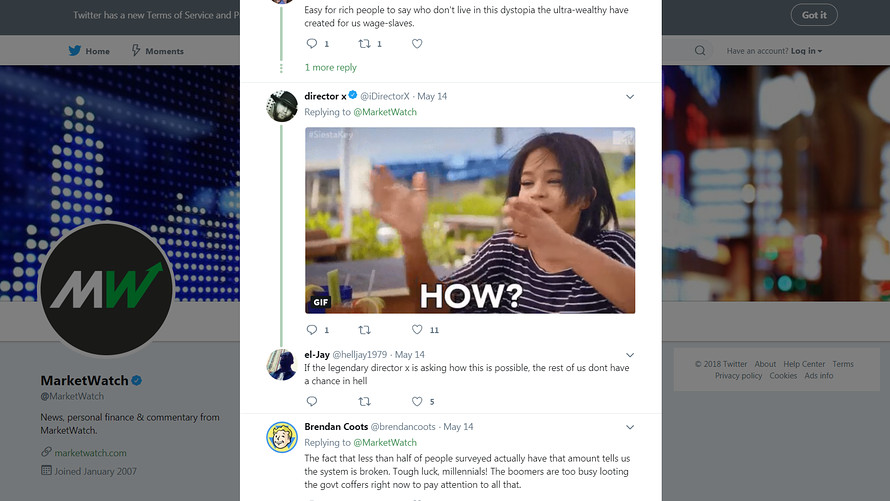

Twitter blew up after MarketWatch tweeted about the piece, where I cite a Fidelity Investments report that suggests 35-year-olds should have twice their salary saved. Even the Huffington Post, BuzzFeed and Business Insider wrote about the backlash. Of the thousands of reactions, many made jokes but most others were defensive and angry. They talked of crippling student loan debts, having low or no income and blamed the gender wage gap.

The response highlighted just how anxious people feel about their financial responsibilities and the obstacles that outweigh saving for retirement. Twitter users said the Fidelity figure, which was meant as a guideline more than anything, was impossible for real people to achieve and made them feel they had fallen behind.

Young adults are financially struggling, and already have to make tough choices about what they can spend their money on, said David Yankovich, 31, who had originally retweeted the story saying the piece was condescending and missed other factors at play, such as the state of health care in the U.S. “It’s so hard when you’re in your 20s to even get ahead — by the time you’re in your 30s, you’re not devastatingly broke anymore,” he said. “When you’re that hard-core strapped for money, you’re not thinking of savings, you’re thinking about eating,” he said.

But here’s the unfortunate truth: 30-somethings today need to save for retirement. It’s not easy, or fun, but it’s a necessity. Do they need to have twice their salary? No. But saving for retirement should be a priority, financial advisers said. Why? Because millennials are largely on the hook for financing their own retirement. Fidelity spoke with MarketWatch after the Twitter storm, and said that the firm had calculated how much a person would need to replace 45% of his income. It was meant to engage people, and get them on track to saving for their retirement, so that they didn’t realize in their 60s that they had fallen short. “It’s hard to make up for lost time,” said Jeanne Thompson, senior vice president at Fidelity.

There is no one-size-fits-all figure to tell a person how much they need to have saved, but there are guidelines and calculations to provide a ballpark estimate and ensure retirement preparedness. One way to do so is to focus on the age you want to be when you retire, not just the age you are now, said Jamie Hopkins, the retirement income program co-director at the American College of Financial Services, based in Bryn Mawr, Penn.

For example, if you’re 35 today and want to retire at 65, you have 30 years left to work. Assume you want to be retired for 30 years and replace half of your income in retirement from your savings. You need to invest 15% of your income a year. If you plan to work for 40 years — and retire at 70 — you’ll only need to save about 7.5% a year. (Both of these calculations assume an 80/20 equity to bond investment mix, he said). “As people start living longer the biggest challenge is not going to be saving, it is going to be figuring out how to stay in the workforce well into one’s 70s and perhaps 80s,” he added.

Decades ago, pension plans and Social Security were enough to cover the 10 or so years in retirement. Millennials’ futures, however, will likely look nothing like that. Companies have shifted to defined-contribution plans instead of defined benefit (or pension) plans, which means we are contributing to retirement accounts with our own dollars. Social Security benefits may face cuts in the next few decades. People are working well into their 70s, or switching from full-time to part-time work to supplement their retirement income from their savings. Retirement isn’t just a few years anymore either, and can last decades.

Here’s where people in their 30s currently stand, and why many of them probably reacted the way they did:

• Not many are close to that benchmark of having twice their salaries in retirement savings. The median retirement savings for a worker in their 30s was $45,000, according to Transamerica Center for Retirement Studies, which looked at workers’ retirement accounts. Another analysis by the U.S. Census Bureau found the median net worth for householders between 35 to 44 years old was even less: $35,000.

• There were 12.1 million student loan borrowers between the ages of 30 to 39 years old who had $408 billion in debt in 2015, according to a Value Penguin analysis of Federal Reserve data.

• The percentage of civilian labor force participation for people between 25 and 34 years old dropped from 84.1% in 1996 to 81.6% in 2016; for people 35 to 44 years old, those figures were 84.8% in 1996 to 82.4% in 2016, according to the Bureau of Labor Statistics.

• The 30s are also a time for many to get married, buy a home and have children — all of which are expensive. Plus, rent and interest rates are rising and employee wages are stagnant.

• More than half of Americans 30 to 39-year-olds (55.8%) report feeling better off than their parents at the same age, but 23.1% said they feel they are about the same and 20.7% feel worse off, according to Federal Reserve data. A report from advocacy group Young Invincibles disagrees with that sentiment, saying young people today earn lower incomes than their parents did. (The report analyzed Federal Reserve Board of Governors public surveys from 1989 and 2013).

There’s one more consideration: People may simply not want to sacrifice things they spend their money on to put away a few extra dollars for the future. This does not mean depriving yourself, as that will backfire, said Kali Hawlk, financial writer at Going Beyond Wealth, but it does mean understanding what is worth spending money on and what isn’t. “It’s hard to do it so we don’t do it a lot of the time,” she said. “When something or someone points it out, we get defensive.” The easiest, though perhaps not as exciting way to do this is by looking over your financial transactions and making a budget. If buying coffee or going to brunch is important, make time and money available for that, and trim expenses elsewhere that have become a habit but mean very little to you.

What else to do?

• Don’t panic yet. If you’re not in the position to invest 15% of your income, try your best to put as much as you can into a retirement account. If you trim your expenses, you may end up with extra money at the end of every pay cycle that can be dedicated to retirement funds, said Desirae Odjick, a personal finance blogger at Half Banked. “Not everyone can hit this perfect ideal practice but if you can take small steps closer to this guideline — as opposed to farther away — that is good,” she said. “You don’t have to go all in to be a perfect example.”

• When you get a raise, give your retirement account a boost too. If your employer offers an employer match for a 401(k) plan, consider taking it as it is basically free money. Another strategy is to increase your contribution rate by 1% every year.

• Going into retirement with debt isn’t advised, nor is stretching loans for longer than necessary as you end up paying more in interest. One goal could be to have saved your salary’s worth for retirement and repaid your salary’s worth in loans as well, said Willian Nathan Greene, a financial adviser at Shoemaker Financial in Brentwood, Tenn.

• Just start. “Don’t let the big numbers stop you from even starting,” said Scott Bishop, partner and executive vice president of financial planning at STA Wealth Management in Houston. Eventually those small deposits will snowball, said Ashley Foster, a financial adviser at Nxt: Gen Financial Planning in Houston. Compound interest, which is the interest earned on top of investments with interest, will play a key role in generating more wealth, he said.