Dividend stocks, in general, are the best kinds of investments to have in retirement. They provide both the supplemental income when it’s time to rely on one’s nest egg while also allowing retirees to keep growing wealth through stock appreciation and higher dividend payments over time. That isn’t something you are going to get from cash under a mattress or from bonds.

Making the most of dividends in retirement means picking great dividend stocks that will be able to provide a steady stream of income for years to come, and it’s helpful if said stocks pay a high yield today. So we asked three Motley Fool investors to each highlight a stock they think is a perfect fit in a retirement portfolio. Here’s why they picked Walmart (NYSE:WMT), Brookfield Renewable Partners (NYSE:BEP), and Copa Holdings (NYSE:CPA).

IMAGE SOURCE: GETTY IMAGES.

A growing e-commerce story

Daniel Miller (Walmart): Investors looking for the perfect stock during retirement should aim for a relatively stable company with competitive advantages that’s returning consistent value to shareholders. Few companies can claim to do those things as well as Walmart and over the past decade Walmart has consistently repurchased shares and increased its dividend.

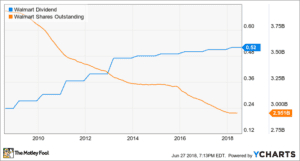

WMT DIVIDEND DATA BY YCHARTS.

While Walmart’s dividend increases have slowed recently as the company made key acquisitions, its fiscal year 2019 increase to a quarterly $0.52 dividend is still a healthy 2.4% yield. It was the 45th consecutive year the company increased its dividend and during fiscal 2018 the retail juggernaut returned a staggering $14.4 billion to shareholders in the form of dividends and share repurchases – rest assured, Walmart will consistently return value to shareholders.

Walmart has also made smart moves to invest in its future, especially its 2016 Jet.com acquisition and 77% stake in Flipkart in May. Initially, the investing community believed that Walmart vastly overpaid for Jet.com, an unproven e-commerce business, in a desperate attempt to do something with its online sales. It took barely a year for investors to come around to its e-commerce moves, and Morningstar.com estimates Walmart can grow online sales 35% annually to boost online sales from 5% of total sales during fiscal 2018 up to around 15% within three to four years.

With more than 11,700 stores in 28 countries and 2018 revenue of $500 billion, Walmart is a powerhouse in scale, pricing power, and distribution. Don’t be surprised if it’s one of a few, if any, that will challenge Amazon.com with e-commerce and grocery delivery. In the meantime, it will continue to dish massive value to shareholders through dividends and share repurchases.

Good assets managed by a great capital allocator

Tyler Crowe (Brookfield Renewable Partners): Personally, I think dividend investors will get the best bang for their buck from a dividend stock with companies that can offer a rather generous yield an maintain a reasonable growth rate. For a company to be able to achieve these two things over the long haul, it needs to have a business model that has quite a bit of clarity several years out, and a management team with a proven track record of capital allocation. Brookfield Renewable Partners checks every one of these boxes.

Brookfield Renewable owns and operates about $25 billion in power-generating assets globally, most of which are hydropower stations. The assets it owns have contracts in place that give an immense amount of revenue clarity for several years into the future. Being able to project revenue with such certainty allows Brookfield to distribute such a large portion of its cash to shareholders in the form of a dividend currently yielding 6.6%.

Having assets that throw off a lot of cash isn’t that uncommon, though. What’s rare is a management team like Brookfield’s that can effectively manage the growth of the business when so much cash is dedicated to investors. One thing that Brookfield’s management has proven to be quite adept at is sniffing out undervalued investments and buying them at discounted or distressed rates. Examples were when it bought hydropower stations in Colombia at an auction where it was the only participant as well as the acquisition of TerraForm Global when its former parent, SunEdison, was in bankruptcy proceedings. Buying assets when they are out of favor has led to higher rates of return.

This formula, coupled with prudent management of the balance sheet, has worked exceptionally well for the company as it has outpaced the S&P 500 on a total return basis by a wide margin. As long as Brookfield sticks to this strategy, its stock should continue to reward investors for a long time.

Fly the dividend skies

Rich Smith (Copa Holdings): In her just-released updated edition of How to Retire Overseas (Everything you need to know to live well (for less) abroad), travel writer Kathleen Peddicord speaks glowingly of Panama City, Panama, as a perfect destination for retirement — so much so that she recently moved to the city as her own business’s new home base.

Panama City has a little bit of everything that retirees might want, starting with a low cost of living, and running through first-world infrastructure and a first-rate healthcare system, tax benefits for retirees and ease of opening a business in retirement, and ending with easy access to “home” in the U.S.

One of the reasons American retirees in Panama City have such easy access to U.S. cities is Copa Holdings, parent company of Copa Air, which services 75 destinations in 31 countries (the U.S. included) out of its hub and headquarters in Panama City.

Copa is growing like a weed — and I’m not just talking about its flight plans. Copa pays its shareholders a big 3.7% dividend yield, but it’s so profitable that this consumes barely 30% of its profits. Copa reported $404 million in GAAP profit over the past year, giving it a P/E ratio of 10. That compares favorably to analysts’ projected 13% growth rate for the stock — and Copa is even cheaper when valued on free cash flow.

If you’re a retiree, and perhaps considering Panama City as a place to retire, I think Copa Holdings is a fine dividend stock to consider investing in as well.