Social Security is a retirement program that tens of millions of seniors rely on. Data from the Social Security Administration (SSA) shows that 62% of all retired workers depends on the program for at least half of their monthly income, with about a third of all seniors leaning on Social Security for virtually all of their income (90% to 100%). Without Social Security, the elderly poverty rate would be considerably higher than it is today.

Because of its importance in laying down a financial foundation for aged beneficiaries, there’s arguably no decision that’s more important for seniors than when to claim benefits. After all, claiming at the wrong age could mean leaving tens of thousands of dollars on the table over your lifetime.

First, let’s take a closer look at what factors go into calculating your Social Security benefit, then we’ll lay out the parameters of what it’ll take for you to receive your full retirement benefit.

How your Social Security benefit is calculated

Though I’d previously identified seven factors that could affect what you ultimately get to keep from Social Security, there are four primary factors that determine what you’ll be paid:

- Your work history

- Your earnings history

- Your claiming age

- Your birth year

The first two factors go hand in hand. When calculating your retired worker benefit, the SSA will account for your 35 highest-earning, inflation-adjusted years. This means that you’d obviously want to earn as much as possible in each year you work, and that in order to really maximize what you’ll receive from Social Security, you’ll want to work at least 35 years. This is where working later in life can come in handy. Having built up skills and work experience, you have the potential to earn significantly more per year later in your career, relative to what you earned in your teens or 20s.

The wildcard of these factors is your claiming age, because it’s entirely up to you and your financial/personal circumstances. The SSA allows eligible beneficiaries to begin receiving their Social Security retirement benefit at age 62 or at any point thereafter. However, the dangling carrot of sorts is that for each year you hold off on claiming benefits, your payout will grow by approximately 8%, until age 70. Thus, if we were looking at two identical individuals, the one who claims benefits at age 70 could earn up to 76% more per month than the one who claims as early as possible at age 62.

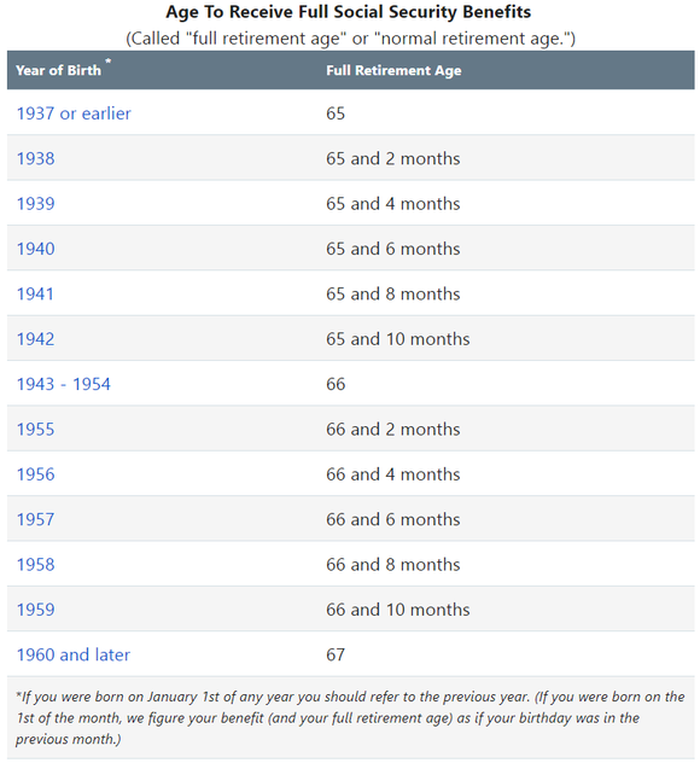

The final significant factor is your birth year, which is what determines your full retirement age, or the age at which you become eligible for 100% of your monthly payout.

Here’s how you can collect your full retirement benefit

To state the obvious, we don’t get to determine when we’re born. But the card we’re dealt (i.e., our birth year) is what determines how long we have to wait (assuming we’re eligible for retired worker benefits) to receive our full retirement benefit. Here’s a table provided by the SSA of full retirement ages, based on your birth year.

As you can see, for baby boomers and today’s working Americans, your full retirement age falls between 66 and 67 years. This means the typical boomer probably has to wait until age 66, or perhaps up to age 67, to receive his or her full benefit. Meanwhile, Generation X, millennials, and Generation Z will have to wait until age 67 if they want 100% of what they’re due.

Should you choose to claim earlier than your full retirement age, your monthly benefit can be permanently reduced by up to 30%, depending on your birth year and the age at which you claim. Conversely, waiting even longer (until age 70) could actually up increase your retired worker benefit by as much as 32%, once again depending on your birth year.

Two important considerations

However, there are two consideration that pre-retirees need to make prior to claiming Social Security’s retired worker benefit.

For starters, waiting until your full retirement age may not always be beneficial. Though the prospect of waiting a few years to receive a bigger check each month probably sounds like a great plan, it may not be an option for folks dealing with a chronic health condition, or seniors who are out of work and don’t have another income stream. Not everyone necessarily benefits by waiting, which means you’ll need to weigh the pros and cons of waiting relative to your own financial and personal health.

The other consideration here is that Social Security is itself not in the best of health. According to the 2018 Board of Trustees report, it’s expected to begin paying out more in benefits than it’s generating in revenue this year, and continue to do so moving forward. By 2034, Social Security’s $2.9 trillion in asset reserves are projected to be completely exhausted. If Congress isn’t able to resolve the program’s $13.2 trillion cash shortfall through 2092, a 21% across-the-board cut in benefits could await.

Why does this matter? For those workers set to hit their full retirement age within a few years of 2034, it might be worthwhile to consider taking their benefits a few years earlier, even taking into account the fact that their benefits would be permanently reduced. In doing so, and assuming Congress fails to raise additional revenue for the program, at least these folks would generate a potentially higher payout for a few years prior to the across-the-board reduction.

Ultimately, there is no perfect road map for when to claim benefits. It’s a personal decision that can, as you see, have quite the impact on what you’ll net over your lifetime from Social Security.