2017 was an absolutely banner year for the stock market. After historically rising by 7% a year, inclusive of dividend reinvestment and when adjusted for inflation, the broader market catapulted higher by nearly three times that amount last year. And with it, some of the hottest stocks logged triple-digit percentage gains. Payment processor Square (NYSE: SQ) gained 154%, online home-goods retailer Overstock.com (NASDAQ: OSTK) surged 265%, and Latin American e-commerce giant MercadoLibre (NASDAQ: MELI) vaulted higher by 102%.

But the big question is: Can these top performers continue pushing higher?

Image source: Getty Images.

With this in mind, we asked three of our Foolish investors whether they believed Square, Overstock.com, and MercadoLibre were still buys today. Here’s what they had to say.

Mobile payments aren’t going anywhere

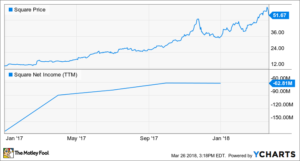

Travis Hoium (Square): Payment processing company Square has had an incredible run the past 15 months, nearly quadrupling in value for investors. The gains have been driven by Square’s revenue growth and an improving bottom line, which investors hope will continue. Square isn’t profitable yet, but if businesses continue to adopt the company’s platform it’s possible the company will be able to start reporting positive net income soon.

What Square has been able to leverage the last few years is its suite of products that surround its payment processor, including calendars, inventory management, an e-commerce platform, and more. If you’re starting a food truck, salon, or coffee shop, Square makes all the sense in the world. That’s the foundation of the company right now, but it’s just scratching the surface of its potential.

Where Square has struggled, and where it has a great opportunity, is in businesses with over $500,000 in annual payment volume. Square is an attractive point-of-sale system for businesses with very small transactions, because the 2.75% flat fee is less expensive than other options. But as transaction prices go up, the attractiveness of Square’s fees goes down. Visa’s interchange rates are 1.51% plus $0.10 for a credit card transaction and 0.8% plus $0.15 for a debit card transaction, and most processors charge a small fee on top of Visa’s fee. Square does custom rates for some larger customers, but it’s missing an opportunity to grow into higher-transaction businesses with its current fees and locking itself into money-losing low-volume transactions. Creating a fee structure that would increase profitability for low-revenue transactions while attracting more high-revenue transaction businesses could drive Square’s stock significantly higher. That’s where I see upside for the stock in the future.

Given its payment platform and services, Square has become a go-to for small businesses across the country, and I think the company can expand that to higher revenue businesses as well, driving growth for many years to come. That’s why I think Square is still a buy, despite the stock’s gains already seen in the past year.

Should you “Go for the O”? Well, no.

Sean Williams (Overstock.com): Few stocks were on fire in 2017 quite like online home-goods retailer and now blockchain developer Overstock.com. From start to finish, Overstock shares galloped higher by 265%.

Overstock has benefited from the emergence of blockchain technology — the digital, distributed, and decentralized ledger that’s often tethered to cryptocurrencies and is responsible for logging all transactions — which is being developed by a subsidiary. It also rose in step with cryptocurrencies as it’s been accepting bitcoin and a few dozen other virtual currencies as payment on its online website. Overstock has been hanging on to a growing percentage of its virtual currency holdings, rather than converting them immediately into cash, which has boosted its underlying valuation as the market value of digital currencies has soared.

The big question is, can this rally continue? Put plainly, this investor isn’t convinced.

If we look at Overstock’s core online home-goods business, it’s rather unexciting. Despite its niche focus and the convenience of online purchases, Overstock.com hasn’t been able to hold a candle to Amazon.com. Amazon has deeper pockets and a considerably more loyal customer base, leaving Overstock muddling along with a mid-single-digit growth rate and breakeven profitability. That’s hardly worth a 265% increase in share price.

What’s more, CEO Patrick Byrne is practically going all-in on blockchain development and has tinkered with the idea of selling Overstock.com’s online business to fund blockchain development at its subsidiary. Even if blockchain proves to be the game-changing technology that everyone believes it could be, the chance that will happen within the next few years is slim. We’re still trying to move beyond the proof-of-concept conundrum, which makes placing too much faith in blockchain a potential mistake.

Should investors be buying Overstock.com following its 265% rise in 2017? Heck, no!

This is just the beginning

Danny Vena (MercadoLibre): After years of being held back by fears involving political unrest, hyperinflation, and currency devaluation, Latin American e-commerce leader MercadoLibre roared ahead in 2017, gaining over 100% — five times the performance of the S&P 500. Improving economic and political conditions in the region spurred the company’s results to new heights. In light of the stock’s significant spike, however, investors will rightly be asking themselves if MercadoLibre is still a buy.

A look at what drove the company’s gains last year might give us insight into whether MercadoLibre still has gas in the tank.

Worldwide e-commerce is expected to grow to $4.88 trillion by 2021, more than double the $2.3 trillion achieved in 2017. MercadoLibre stands to benefit from the increasing adoption of online sales. Over the years, the company has worked to remove the friction points that kept consumers from joining the e-commerce revolution.

MercadoLibre created its own online payment service, MercadoPago, that has been a key to its success, as 70% of consumers in the region don’t have a bank account and only between 20% and 50% have a credit card, depending on the country. The company also created its own shipping solution, MercadoEnvios, and has been rolling out free shipping, to counter the coming encroachment of Amazon.com.

The company also helps solve issues for business owners in a variety of ways. MercadoLibre provides working capital loans to vendors in a region that has low penetration rate for typical banking services. The company has more than a decade of granular data for longtime merchants, allowing it to more accurately assess the likelihood of repayment. It also provides an easy-to-adopt platform vendors can use to set up online sales.

With a host of advantages and an improving business climate, MercadoLibre seems destined to continue the significant gains it achieved in 2017.