Shares of HP (NYSE: HPQ) jumped on Feb. 23, after the PC and printer maker posted first-quarter earnings that topped analyst estimates. Revenue grew 14% annually to $14.5 billion, beating expectations by $1 billion and marking its strongest quarterly growth since it split with Hewlett-Packard Enterprise in late 2015. Non-GAAP earnings rose 26% to $0.48 per share, topping expectations by $0.06 and representing its highest quarterly profit in six quarters.

Those headline numbers were solid, but there were four other reasons to love HP’s report.

Growth in the PC business

During the quarter, HP’s personal systems revenue rose 15% annually to $9.4 billion, marking its fifth straight quarter of double-digit growth. That was impressive, considering the unit faced a tough comparison to its 10% annual growth in the prior-year quarter.

Sales of commercial and consumer PCs rose 16% and 13%, respectively. Total shipments grew 7%, with notebook shipments rising 8% and desktop shipments climbing 6%.

HP finished the quarter with a 23.5% share of the global market, a 1.7 percentage-point jump from a year earlier and good enough to secure its position as the world’s the top PC vendor.

HP was also one of three companies — the other two being Dell and Apple — that achieved positive growth during the quarter. The other three leading vendors — Lenovo, Asus, and Acer — posted flat to negative growth.

CEO Dion Weisler attributed that growth to “amazing design, innovation, and a consistent focus on leveraging customer insights to create and deliver experiences that amaze.”

Indeed, HP won 77 awards for innovation at the Consumer Electronics Show in January, and it continues to launch notable new devices — including a new 15-inch Spectre x360 convertible PC, the HP Pavilion Wave compact desktop with the Alexa digital assistant built in, the enterprise-oriented EliteBook 800 notebook series, and Omen gaming PCs.

Growth in the printing business

HP’s Printing revenue rose 14% annually to $5.1 billion, as its total hardware shipments climbed 14%. Commercial hardware shipments surged 73%, consumer hardware shipments rose 7%, and supplies revenue advanced 10%.

The big jump in commercial revenue came from HP’s acquisition of Samsung’s (NASDAQOTH: SSNLF) printing unit, which closed on Nov. 1. That acquisition significantly boosts HP’s market share in A3 printers and scales up its A4 printer business.

The printing business also posted year-over-year growth in graphics and managed print services revenues. The graphics business benefited from strong demand for its Indigo and PageWide presses, while its managed print business benefited from a market shift toward contractual printing services.

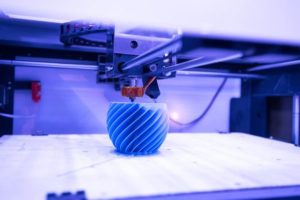

HP’s 3D printing business, which targets industrial customers, also continues to evolve. The company recently introduced a new low-cost color 3D printer for creating engineering-grade prototypes in multiple colors, making HP the only 3D printing company that provides both prototyping and industrial production capabilities on a single technological platform. HP also plans to expand into other 3D printing markets, including metal printing, in the near future.

Stable operating margin

Many PC makers’ margins have declined in recent quarters, because of the rising costs of hardware components such as memory chips. Likewise, the operating margin in HP’s personal systems unit slipped 0.2 percentage points annually to 3.6% during the quarter, but robust revenue growth offset the decline.

CFO Catherine Lesjak anticipates “increased component costs” throughout the year, especially in DRAM prices, but plans to offset those costs by raising prices, leveraging the scale of HP’s supply chain, tweaking its product mix toward higher-margin products, and riding currency tailwinds in certain markets. Memory prices are also cyclical — so when the downturn finally starts, HP’s PC margins will quickly expand again.

The printing unit’s operating margin slipped 0.2 percentage points to 15.8%, but that dip is a temporary one caused by the ongoing integration of S-Print, the Samsung printing unit. Once that integration concludes, the increased scale should significantly boost margin.

Rosy guidance and a low valuation

HP expects 12.5%-22.5% earnings growth during the second quarter, which easily beats the consensus estimate for 10% growth. For the full year, HP anticipates 15%-21% earnings growth — which also crushes Wall Street’s forecast for 10% growth.

HP stock currently trades at just 11 times this year’s earnings. When we combine that figure with its forward yield of 2.6%, and assuming HP hits the midpoint of its earnings guidance for 2018 of $1.95 per share, HP seems like a rock-solid investment for conservative income investors.

The bottom line

I’ve repeatedly stated that the “new” HP is a great long-term investment, since its evolving PC business is leaving rivals in the dust as its printing business scales up and enters new markets. HP might initially seem like a dull, slow-growth stock, but its double-digit revenue and earnings growth during the first quarter indicates that it could still have a lot more room to run.