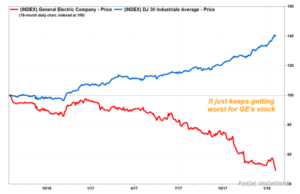

GE shares suffering worst 5-day stretch in nearly 9 years, are now less than 1/20th the price of the highest-priced Dow stock

As General Electric Co.’s stock falls further behind its peers to fresh multiyear lows, the risk of it snapping its record 110-year run within the Dow Jones Industrial Average keeps increasing.

The struggling industrial conglomerate’s stock GE, -3.04% plunged 3% Friday to the lowest close since Dec. 2, 2011, in the wake of the company’s disclosure this week of massive losses in its legacy insurance business.

The 14.5% plunge amid a five-session losing streak is the biggest 5-day decline since it shed 17.0% in the five days ending March 6, 2009.

It has now tumbled 31% over the past three months and 48% the past 12 months, while the Dow industrials DJIA, +0.21% have rallied 13% the past three months and 32% the past year.

With the stock closing at $16.26, the price is less than 1/20th the price of the highest-priced Dow stock, which is currently Boeing Co.’s BA, -0.71% at $337.73.

Price is important for the keepers of the 121-year old index, because the index is price weighted, meaning the higher the price of the stock, the more influence it has on the index’s price. For example, a 1% move in GE’s stock has about a 1-point effect on the Dow, while a 1% move in Boeing shares moves the Dow by about 23 points.

In contrast, many other benchmark indexes, like the S&P 500 index SPX, +0.44% are market-capitalization weighted, meaning the more valuable the company, the more influence it has on the index’s price.

Although there are no hard and fast rules regarding price for current and future Dow members, David Blitzer, chairman of the index committee at S&P Dow Jones Indices, has previously told MarketWatch that the committee prefers the “ratio of the highest to lowest price be less than 10-to-1.”

There are currently eight Dow stocks with prices that are more than 10-times the current price for GE shares. It’s a lot easier to change one component than to change eight.

The Dow keepers

The committee that oversees the Dow is made up of three representatives of S&P Dow Jones Indices and two representatives of The Wall Street Journal. The WSJ is owned by News Corp, which also owns MarketWatch.

Although S&P Dow Jones Indices didn’t say when the index committee meets next, or when it met last, the index’s methodology states that the committee meets “regularly”:

“At each meeting, the Committees review pending corporate actions that may affect index constituents, statistics comparing the composition of the indices to the market, companies that are being considered as candidates for addition to an index, and any significant market events.”

The committee said it reserves the right to “revise” index policy covering rules for selecting companies, the treatment of dividends, share counts or other matters.

A possible break up of the company would give committee members more fodder to remove GE for a third time.

GE’s 110-year Dow streak

GE was an original member of the Dow, when the index launched on May 26, 1896 was 12 “smokestack” companies. The other 11 were American Cotton Oil, American Sugar, American Tobacco, Chicago Gas, Distilling & Cattle Feeding, Laclede Gas, National Lead, North American, Tennessee Coal & Iron, U.S. Leather pfd. and U.S. Rubber.

GE was replaced in September 1898 by U.S. Rubber, and rejoined the index seven months later.

On April 1, 1901, GE was replaced again, until it was added back in for good on Nov. 7, 1907, to replace Tennessee Coal & Iron. None of the other fellow Dow members at the time remain today.

The Dow’s members on Nov. 7, 1907, were:

Amalgamated Copper, American Car & Foundry, American Smelting & Refining, American Sugar, Colorado Fuel & Iron, General Electric Co., National Lead, Peoples Gas, U.S. Rubber, U.S. Rubber 1st preferred, U.S. Steel and U.S. Steel preferred.

Membership increased to 20 on Oct. 14, 1916, then to 30 on Oct 1, 1928.

Since GE last entered the Dow, the index’s composition has changed 50 times, the last time on March 19, 2015, when Apple Inc. AAPL, -0.45% replaced AT&T Inc. T, +0.16%

The most likely month for Dow changes since November 1907 has been March, with seven changes during that month, followed by January with six changes and April, August and September with five changes. The least likely month for a change has been February, with just two changes.

While getting booted from the Dow would be an unfortunate turn of events for GE, which ended the year as the most valuable U.S. company as recently as 2005, but it may not be such a bad thing for the company’s shareholders.

Shares of the last several companies that were removed from the Dow outperformed their replacements by wide margins in the year after the changes were made.