Stock Markets

The new year 2023 registered a strong showing in its first month, a welcome development after a challenging 2022. In its last full week of trading for the month, the stock markets recorded a solid week of gains. This is the third weekly gain of the last four, buoyed by a series of corporate earnings announcements and encouraging economic reports. So far this year, stocks have gained by approximately 6%. This is encouraging since strong returns in January are typically accompanied by positive full-year returns. A mild economic downturn is still possible, though even in such a case, the markets will not likely breach last October’s low levels. Markets may experience bouts of volatility as the markets discount the coming earnings and economic data.

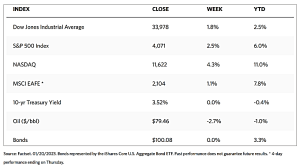

Despite continued recession worries, investors nevertheless appear hopeful that the economy might avoid a recession altogether in 2023. Consumer discretionary stocks were particularly strong, partly due to a rally in Tesla shares over the week after CEO Elon Musk released a favorable outlook. Stocks that underperformed included the usually defensive consumer staples, health care, and utility segments. Overall, value stocks lagged behind growth shares. The weekly WSJ recap shows that the Dow Jones Industrial Average inched upward by 1.81% while the total stock market rose by 2.58%. The S&P 500 Index gained by 2.47% while the technology-heavy Nasdaq Stock Market Composite added 4.32%. The NYSE Composite also rose by 1.17%. The risk perception tracker CBOE Volatility Index declined by 6.75%.

U.S. Economy

Contrary to speculation, the country is not yet out of the woods regarding its economic recovery, despite fairly solid GDP growth by the close of 2022. Last week, the fourth-quarter GDP and household spending reports were released. The GDP grew by 2.9% in the first quarter; however, the headline GDP figure was supported by gains in the inventory and trade categories, the smaller and less sustainable drivers of the U.S. economy. The underlying trends still suggest that consumer spending may be showing signs of fatigue and losing momentum, possibly signaling a soft economic recession. The lagged effects of restrictive U.S. Federal Reserve policy may well produce a mild economic downturn this year.

Nevertheless, the economy should find support from the strong starting point for the labor market that is further underscored by another job in initial jobless claims. The Fed may also implement more rate hikes that should be smaller than the 0.75% adjustments of the past year. After a few such hikes, the Fed will move to the sidelines. Monetary policy will not quickly resume its stimulus stance, however, diversified portfolios should benefit in the year after the greater part of the Fed’s rate-hiking cycle.

Metals and Mining

The gold’s bull run appears to be slowing down after the last two months of solid gains. Gold prices appear to be hitting resistance on its rise to $2,000 per troy ounce, but this may be a welcome consolidation before it could again challenge this resistance level. The recent run-up has shown some welcome developments for the yellow metal. As the price tested resistance around $1,940, it rose 20% above its lows in November and as a result, entered into a technical bull market. The market has risen by approximately $100 this month, its best start to the year since 2012. Gold notched its sixth consecutive weekly gain despite the muted market response; nevertheless, this marks its longest winning streak since the summer of 2020.

The spot prices for precious metals continued to consolidate this past week. Gold rose above last week’s close of $1,926.08 by 0.10% to close this week at $1,928.04 per troy ounce. Silver, whose previous close was at $23.93, slid by 1.38% to close this week at $23.60 per troy ounce. Platinum, formerly ending at $1,045.88, lost 2.88% to end this week at $1,015.74 per troy ounce. Palladium, which ended the previous week at $1,735.81, slumped by 6.46% to close this week at $1,623.59. The three-month LME prices for base metals generally moved sideways. Copper came from last week’s price of $9,324.00 to close at this week’s price of $9,263.50 per metric tonne, slightly lower by 0.65%. Zinc ended this week at $3,413.50 per metric tonne, lower by 0.20% from last week’s closing price of $3,420.50. Aluminum ended this week at $2,627.00 per metric tonne, slightly increasing by 0.63% from the previous week’s price of $2,610.50. Tin came from its week-ago level of $29,536.00 to close this week at $30,838.00 per metric tonne, a gain of 4.41%.

Energy and Oil

Despite being weighed down by high inflation, rising interest rates, and other economic shocks, the stronger-than-expected GDP data released this week sparked hopes of market bulls that the fears of a long-term sluggish economy may have been exaggerated. Macroeconomic events are still correlated with the oil markets. Going almost unnoticed is how U.S. refining is still below 15 million barrels per day (bpd) and is on its way toward a massive round of maintenance. On the European front, EU officials are hinting that they would seek to set the price cap of high-value Russian products at $100 per barrel and of low-value ones at $45 per barrel. The EU governments should now decide whether or not to approve the measure before the February 5 deadline.

Natural Gas

For this report week starting Wednesday, January 18, and ending Wednesday, January 25, 2023, the Henry Hub spot price fell by $0.03 from $3.11 per million British thermal units (MMBtu) at the start of the week to $3.08/MMBtu at the week’s end. The price of the February 2023 NYMEX contract decreased by $0.244, from $3.311/MMBtu to $3.067/MMBtu week-on-week. The price of the 12-month strip averaging February 2023 through January 2024 futures contracts declined by $0.142 to $3.411/MMBtu. International gas futures prices decreased for this week. the weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $2.43 to a weekly average of $22.42/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid gas market in Europe, decreased by $0.42 to a weekly average of $19.67/MMBtu. In the corresponding week last year (the week ending January 25, 2022), the price in East Asia was $22.99/MMBtu, and at the TTF was $27.67/MMBtu.

World Markets

European shares gained ground as positive economic reports overcame concerns about the current stance of central banks toward monetary policy tightening. The pan-European STOXX Europe 600 Index closed the week higher by 0.67%. Major stock indices across Europe also moved higher. Germany’s DAX Index advanced by 0.77%, France’s CAC Index rose by 1.45%, and Italy’s FTSE MIB Index surged by 2.56%. The UK’s FTSE 100 Index registered a modest loss. In the UK, benchmark 10-year yields closed near their recent highs ahead of a Bank of England policy meeting. Meanwhile, European Central Bank (ECB) Governing Council member Klaas Knot called for half-point interest rate increases at the next two policy meetings, causing French and Swiss bond yields to rebound from midweek lows. ECB President Christine Lagarde, fellow Governing Council member Olli Rehn, and Knot reiterated calls for significant rate increases in February and March, but Executive Board member Fabio Panetta announced to the press that there was a great deal of economic uncertainty to pre-commit to a specific policy stance beyond February.

The Japanese stock markets advanced this week, with the Nikkei 225 Index recording a 3.12% gain and the broader TOPIX Index rising by 2.90%. Investor sentiment was optimistic after the report of a solid, albeit slower, growth rate by the U.S. economy, ahead of expectations over the final quarter of 2022. A 2.9% expansion is anticipated, raising hopes of a soft recession. Tokyo’s core consumer price inflation, a leading indicator of nationwide trends, also attracted investors’ attention. The inflation indicator rose 4.3% year-on-year in January, exceeding the Bank of Japan’s (BoJ) inflation target for the eighth straight month. This increased the pressure on the BoJ to tighten its ultra-loose monetary policy. The yield on the 10-year Japanese government bond (JGB) climbed to 0.47% from 0.40% by the end of the previous week. The yen softened slightly to approximately JPY 129.91 against the U.S. dollar, compared to JPY 129.56 versus the greenback the week before.

The mainland Chinese financial markets were closed for the week in celebration of the Lunar New Year holiday, from January 21. They will reopen on Monday, January 30. The Hong Kong stock exchange resumed trading on Thursday; the benchmark Hang Seng Index climbed 2.96% during the holiday-shortened week. During the weeklong holiday, China’s domestic activity accelerated significantly on the back of pandemic restrictions being lifted, driving optimism that the economy will recover faster than anticipated. Mobility returned, with 95.9 million trips estimated to be taken via road, rail, air, and waterways in the first four days of the holiday. Total box office sales reached RMB 3.62 billion, outbound air tickets more than quadrupled for the full year, and hotel bookings doubled. Spending by Chinese consumers, however, is expected to remain restrained in the short term while the country continues to recover from three years of pandemic restrictions.

The Week Ahead

Included among the important economic data to be released this week are consumer confidence, unit labor costs, and job openings reports.

Key Topics to Watch

- Employment cost index

- S&P Case-Shiller home price index (SAAR)

- FHFA home price index (SAAR)

- Chicago business barometer

- Consumer confidence index

- Rental vacancy rate

- ADP employment report

- S&P manufacturing PMI (final)

- ISM manufacturing index

- Job openings

- Quits

- Construction spending

- Federal funds rate

- Federal funds projection

- Fed Chair Jerome Powell news conference

- Motor vehicle sales (SAAR)

- Initial jobless claims

- Continuing jobless claims

- Productivity, first estimate (SAAR)

- Unit labor costs, first estimate (SAAR)

- Factory orders

- Core capital goods orders (revision)

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Labor-force participation rate, 25 to 54-year-olds

- S&P U.S. services PMI (final)

- ISM service index

Markets Index Wrap Up