Stock Markets

Stocks were driven sharply lower this week due to concerns that the Federal Reserve may not be able to control inflation without further aggressive rate hikes. Investors fear that further increases in interest rates may well cause a significant economic slowdown. The Dow Jones Industrial Average (DJIA) plunged 4.22% while the total stock market lost 3.84% of its value. The S&P 500 Index gave up 4.04% while the Nasdaq Stock Market Composite lost 4.44%. The NYSE Composite slid 2.63%. The underperformance by the Nasdaq, which fell to its lowest level in a month, compared to the other stock market indexes suggested that technology and other high-growth stocks fared worse in this slowing environment. The rising price of oil further drove inflation worries, but also boosted the energy sector.

It is notable that the major indexes entered a bear market in June, rebounded strongly in July, and inbound to end flat in August, returning to their levels three months ago. Currently, the markets are in search of a reason to move in either direction, with the worst-case scenario for risks having been dissipated although strong resistance to further growth is expected. Volatility is forecasted to remain high in the coming prolonged market recovery.

U.S. Economy

Inflationary pressures seem to be receding, although levels remain far from the Fed’s 2% target rate. The constraints against supply appear to be easing even as demand is weakening. Companies are reporting improved delivery times which indicates that the tight supply chain situation of the past months is lifting. Inventories are rising relative to sales as the economic growth has softened, thus it is likely that inflation for consumer goods is likely to come down significantly in the months to come. It is therefore plausible that the Fed may eventually ease up on its tight monetary policy that it has aggressively pursued so far this year, and adopt a neutral stance that neither stimulates nor restrains growth if the inflation rate continues to improve.

Although the economy continues to slow down, it has been largely policy-driven, therefore it is too soon to tell whether the full effects of the rate hikes have already been felt. Consumption appears to be healthy and sustained, expanding 1.5% after adjusting for inflation, Strong consumer spending is behind the small contraction in the economy indicated after the first revision for the second-quarter GDP. Annualized increase in services rose 3.6% while personal income rose in July due to the tight labor market. However, this trend may be soon arrested as suggested by the upward trend in jobless claims and the declines in the job openings and quit rates.

Metals and Mining

The gold market has once more been stymied in neutral, clinging to its support at around $1,750 per ounce despite the pressure to move downward exerted by increasing interest rates. Market participants, including traders and investors, are still discounting the substance of the comments of Federal Reserve Chair Jerome Powell during the annual central bank symposium. Powell appears to sound hawkish without actually divulging future policy moves. In light of the fluid economic conditions, the central bank’s gold demand will continue to provide critical support for the gold market.

The sport price for gold, which ended the preceding week at $1,747.06, closed this week at $1,738.14 per troy ounce, losing 0.51%. Silver closed at $19.05 previously and this week at $18.90 per troy ounce for a 0.79% drop. Platinum began at $899.21 and ended this week at $866.97 per troy ounce, sliding 3.59%. Palladium, which previously closed at $2,129.59, closed this week at $2,108.87 per troy ounce, dipping 0.97%. The 3-month LME price of industrial metals performed relatively better for the week. Copper, which was previously $8,078.50, closed the week at $8,160.50 per metric tonne, rising 1.02% week-on-week. Zinc began at $3,487.50 and ended the week at $3,565.50 per metric tonne, climbing 2.24%. Aluminum rose week-on-week from $2,386.00 to $2,493.50 per metric tonne, gaining 4.51%. Tin closed the previous week at $24,795.00 and this week at $4,750.00, declining 0.18%.

Energy and Oil

Oil prices were directionless this week. ICE Brent remained at around $100 per barrel as the market’s attention was focused on the likelihood of the successful negotiation of the Iranian deal. The Biden administration relayed its response to the European Union, which acted as a broker between it and Iran in light of their refusal to negotiate directly. According to the grapevine, the proposed terms are far from what Tehran anticipated, effectively creating a “take it or leave it” dilemma for the Iranian leadership. Absent any breakthrough in the Iranian stalemate, the Feds Jackson Hole symposium will continue to drive oil prices. In the meantime, U.S. Energy Secretary Jennifer Granholm, in a letter sent to the country’s leading refiners, called upon them to withhold exports to Europe and South America and commence building up inventories, despite both the gasoline and diesel curves being firmly backwardated.

Natural Gas

For the report week from Wednesday, August 17, 2022, to Wednesday, August 24, 2022, the Henry Hub spot price fell by $0.22, from $9.51 per million British thermal units (MMBtu) to $9.29/MMBtu. The price of the 2022 NYMEX contract increased by $0.086/MMBtu, from $9.244/MMBtu at the start of the week to $9.330/MMBtu at the end of the week. The price of the 12-month strip averaging September 2022 through August 2023 futures contracts rose $0.114 to $7.659/MMBtu. The weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $9.06 to a weekly average of $59.01/MMBtu, and natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas spot market in Europe, increased by $12.53 to a weekly average of $77.60/MMBtu.

World Markets

European shares fell due to growing fears that the efforts so far of key central banks to rein in inflation can exacerbate an economic downturn. The pan-European STOXX Europe 600 Index closed 2.58% lower than the preceding week in local currency terms. Major stock indexes likewise declined, with Germany’s DAX Index plunging 4.23%, France’s CAC 40 Index coming down 3.41%, and Italy’s FTSE MIB Index sliding 2.84%. The UK’s FTSE 100 Index suffered a 1.63% loss. Core eurozone government bond yields inched higher in the midst of rising expectations of sharper increases in interest rates and indicators of stalling economic activity. The peripheral eurozone and UK government bond yields tracked core markets broadly. Natural gas levels shot up to record levels after the Russian state-owned natural gas producer Gazprom announced further closures of the Nord Stream 1 pipeline to Europe at the end of August, reasoning maintenance processes. This further weighed on investor sentiments as pipeline flows are currently only at 20% of the agreed volume. The euro traded close to parity with the dollar due to the pessimistic economic outlook.

In Japan, despite a rally late in the week, stocks finished the week lower than they began as investors anticipated an announcement of further rate hikes from U.S. Federal Reserve Chair Jerome Powell on Friday. The Nikkei 225 Index closed at 28,641.4, the week down by 1.0%. The broader TOPIX likewise ended down by 0.75% to close at 1,979.6 for the week. That being said, the week actually brought the bourses into a positive trend. On Thursday, the Nikkei broke out of a five-session losing streak, mainly attributable to positive cues from Wall Street and actions by bargain hunters, extending the gains to Friday. Exporters and technology stocks noticeably led the other sectors. In the bond market, the 10-year Japanese government bond (JGB) yields surged to more than a one-month high on Thursday (0.230%), following the lead of its U.S. counterparts. JGP yields closed the week at around 0.224%, higher than the close of the previous week. Regarding currencies, the U.S. dollar traded firmly against the yen intermittently during the week, however, the yen eventually finished the week broadly unchanged from where it began, at JPY 136.8 against the dollar.

China’s stock markets slumped as concerns about the growth outlook were challenged by extreme temperatures and power shortages in some provinces. The broad, capitalization-weighted Shanghai Composite Index slid 0.67% while the blue-chip CSI 300 Index, which broadly tracks the largest listed companies in Shanghai and Shenzhen, dropped 1.05%. Beijing last week announced that the government will adopt several measures to support the economy. The State Council, China’s cabinet, laid out a 19-point policy package that intends to add CNY 300 billion to state policy banks’ investment in infrastructure projects, over and above CNY 300 billion announced in June. The cabinet further allocated CNY 500 billion of special bonds from previously unused quotas to local governments. China appears geared to flood the economy with excessive stimulus. The People’s Bank of China (PBOC) also cut two key interest rates, contrary to the direction taken by most central banks around the world, in its efforts to revive the economy. The 10-year Chinese government bond yield rose to 2.68% from 2.639% the week earlier. The yuan weakened to 6.8624 per U.S. dollar compared to 6.80 the week before.

The Week Ahead

Unit labor costs and the unemployment rate are among the important economic data scheduled to be released this week.

Key Topics to Watch

- S&P Case-Shiller U.S. home price index (year-over-year)

- Consumer confidence index

- Job openings

- Quits

- New York Fed President John Williams speaks

- Cleveland Fed President Loretta Mester speaks

- ADP employment report

- Chicago manufacturing PMI

- Atlanta Fed President Raphael Bostic speaks

- Initial jobless claims

- Continuing jobless claims

- Productivity revision (SAAR)

- Unit labor costs revision (SAAR)

- S&P U.S. manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Atlanta Fed President Raphael Bostic speaks

- Light motor vehicle sales (SAAR)

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Labor force participation rate, 25-54 years

- Factory orders

- Core capital equipment orders revision

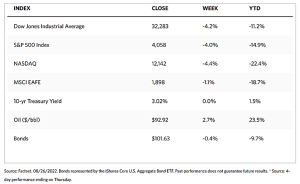

Markets Index Wrap Up