Stock Markets

The S&P 500 moved on to a new record high during an otherwise lightly traded week, helped along by a sharp decrease in longer-term bond yields. Growth stocks were pushed higher by the decline in yields as they tended to reduce the implicit discount on future earnings. Financials were weighed down, however, due to the threat, the falling yields had on banks’ lending margins. The Nasdaq Composite Index was buoyed to a fourth weekly gain by its technology-based stocks. On the other hand, the narrower Dow Jones Industrial Average (DJIA) registered a marginal drop. In the S&P 500, the surge was spearheaded by the health care sector as a result of the strong showing of Biogen. The driver behind optimism in the drugmaker’s shares is the broad authorization granted by the Food and Drug Administration (FDA) to Aduhelm, Biogen’s new product for the treatment of Alzheimer’s disease.

U.S. Economy

The key economic news this week still focuses on the rising inflation rate as the consumer price index (CPI) increased by 5% from year-ago levels. The core index that excludes food and energy rose by 3.8% year-over-year, representing the highest 12-month growth since 1992. This is not remarkable since last year’s prices took a deep plunge during the worst of the pandemic, and prices are only seeking to recover ground lost since then. It is a cause for concern, though, that there is also a strong month-over-month rise in prices. For instance, from April to May, there was a significant spike of 0.7% in the core index when the expected increase was 0.5%, and which is more than thrice the average monthly increase going back five years.

- The price surge in May appears to be mainly attributable to a few categories of goods and services more severely affected by the pandemic. They are experiencing a jump now because the economy is opening up. They include restaurant dining, airfare, car rental, and hotel prices benefitting from the release of pent-up demand as people are returning to their former spending habits. There is still some leeway at the top for prices to continue rising since they are still currently off by 12% from their pre-pandemic levels.

- Despite previous nervous reactions to news of inflation increase, bot the equity and bond markets hardly reacted to the increase in inflation this week. Investors appear to be agreeing with the outlook of the Federal Reserve that price pressures are only temporary as the economy recovers. The two main Fed mandates, employment maximization, and price stability appear to be sending mixed signals, thus the possible further upside in employment leads policymakers to believe that higher inflation can still be tolerated. This is supported by an increase in vaccination rates, growing consumer demand, and rising consumer profits. Some volatility may occur, however, as indicators struggle to find their equilibrium.

Metals and Mining

The price of spot gold dropped by 1.04% to $1,875.31 per ounce, from last week’s $1,894.96, It slipped on the prospect of a stronger dollar and the likelihood that investors have discounted future inflation spikes as transitory. Gold price came from an intra-month high last May of $1,900 per ounce, but it remained above the previous week’s support of $1,860. Gold futures also settled marginally lower at $1,879.6 per ounce. The failure of gold to break above $1,900 suggests the slowdown of inflation hedging flows and opening the possible further softening of gold prices to $1,850 per ounce. Silver slightly rose during the week by 0.68%, from $27.77 to $27.96 in mostly sideways trading. Platinum followed gold downwards, sliding by 0.92% from last week’s close of $1,157.70 to this week’s $1,147.08 per ounce. Palladium ended last week at $2,732 and this week at $2,783.1 for a gain of 1.87% during this week’s trading. It is likely that automobile companies have anticipated the impending worldwide semiconductor shortage and are ideally positioned with their inventories of these two auto catalyst metals, thus the relative lack of volatility in their price movements.

Energy and Oil

Due to the U.S. lifting of sanctions on Iranian officials, oil prices dropped during a Thursday sell-off but showed modest gains on Friday. The U.S. Department announced that it is removing from its list of designated persons three directors of the National Iranian Oil Company (NIOC), and speculations arose that Iran may enhance the current oil supply. Early trading Friday pushed oil prices higher to recover lost ground and post a slight gain on optimistic news about the U.S. economic recovery and the speed-up of the vaccination campaigns globally. These bring increasing pressure on OPEC+ to ease up on their production constraints to circumvent an overheating oil market. The International Energy Agency (IEA) foresees the possibility that global oil demand will rebound and exceed the past pre-pandemic levels by the end of next year. Demand fell by 8.6 million barrels of oil per day (mb/d) in 2020 and is expected to rebound by 5.4 mb/d in 2021, plus another 3.1 mb/d in 2022. There is therefore a need for oil production to be boosted to ensure adequate supply to meet the demand.

Natural Gas

The U.S. exporters of liquefied natural gas (LNG) are poised to significantly increase production in 2021 from the record highs set in 2020 to meet the growing demand in Asia and Europe even during off-peak season. LNG prices are also expected to increase in response to the strong demand in China, as can be seen from the strong gains posted in spot prices in the past weeks. It is likely prompted by the tightening of Asian LNG balances as a result of the strong generation demand in southern China coinciding with the peak nuclear maintenance in South Korea. The LNG demand in India during its recent Covid peak has also stabilized.

In most locations during the past report week covering June 2 to June 9, natural gas spot prices increased. The rise in demand is attributed to the increased air conditioning demand as warmer-than-normal weather descended on most of the country. The increased demand for air conditioning caused a higher demand for natural gas for power generation. The Henry Hub spot price ascended from $3.05 per million British thermal units (MMBtu) at the beginning of the week to $3.10/MMBtu by the week’s end. The price of the July 2021 NYMEX contract inched up by $0.05 from $3.075/MMBtu to $3.129/MMBtu. The price of the 12-month strip averaging July 2021 through June 2022 futures contracts increased by $0.06/MMBtu to $3.108/MMBtu.

World Markets

European shares moved up for the fourth week in a row, partly buoyed by the commitment of the European Central Bank (ECB) to pursue its high rate of bond purchases for the third quarter. For the past week, the pan-European STOXX Europe 600 Index closed 1.09% higher. Germany’s Xetra DAX moved sideways, Italy’s FTSE MIB Index grew 0.57%, and France’s CAC 40 Index outperformed the others by gaining 1.30%. The UK FTSE 100 Index rose 0.92%. Eurozone government bond yields lost ground in reaction to the ECB’s pledge to continue with its bond-buying program at the present pace for the next three months. The ECB forecast likewise indicated that inflation is expected to settle below its 2023 target.

Japanese equities remained relatively unchanged for the week. The Nikkei 225 Index inched up 0.02% while the broader TOPIX Index fell 0.26% on listless trading. The Japanese economic recovery remains fragile, but there was some optimism as the quasi-states of emergency were lifted by the government in three prefectures in light of the slowing infection rates and easing pressure on the hospital system. The yield on the Japanese 10-year government bond dropped to 0.03% which is the lowest encountered since the first month of the year. Japan is included in the list of 110 countries and territories towards which the U.S. Center for Disease Control and Prevention has eased travel restrictions. The yen remained at JPY 109.5 versus the dollar.

Some pessimistic sentiment beset the Chinese bourses as stocks fell for the second week in a row. The CSI 300 Index tracking large-cap stocks dipped by 1.1% as the broader Shanghai Composite Index slipped 0.1$. The renewal of COVID-19 controls by authorities in Guangzhou due to a rise in the outbreak of cases cautioned investors from aggressive positioning in the market. Casino shares also weakened when Macau, responding to the announcement, banned nonresidents from entry through Guangdong province. On the positive side, the U.S. and China agreed to resume talks on trade improvement and investment ties. In its bond markets, the trend in yields moved gradually higher since late May. The yield on the 10-year Chinese government bond closed at 3.15%, four basis points higher, on the prospect of higher producer price inflation. The RMB (renminbi) was unchanged versus the dollar after a trading week of hardly any volatility.

The Week Ahead

Among the important economic data expected next week are retail sales, producer price data, and the leading economic indicator index.

Key Topics to Watch

- Retail sales

- Retail sales excluding autos

- Producer price index

- Empire state manufacturing index

- Industrial production

- Capacity utilization

- Business inventories

- NAHB home builders’ index

- Building permits

- Housing starts

- Import price index

- Federal Reserve announcements

- Fed Chair Jerome Powell press conference

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Philadelphia Fed manufacturing index

- Index of leading economic indicators

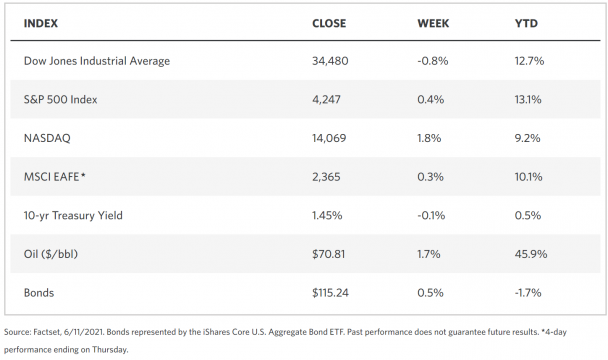

Markets Index Wrap Up