A strict adherence to the Newtonian wisdom that “what goes up must come down” might save you from some stock-related heartache, but it would also cause you to miss out on some of the best investment opportunities in the market. Taking a quick look at the massive gains posted by companies like Amazon and Netflix over the last decade should help to illustrate that point.

Companies that are winning tend to be winning for a reason, and oftentimes they’re positioned to leverage their successes to create even greater growth down the line.

We asked three Motley Fool investors to profile a company that has what it takes to keep winning. Read on to see why they think that SolarEdge Technologies (NASDAQ: SEDG), Best Buy (NYSE: BBY), and Take-Two Interactive (NASDAQ: TTWO) still have room to grow.

This stock tripled in one year — and is ready for more

Rich Smith (SolarEdge): It’s been a good five months since I last picked SolarEdge as a stock that has doubled and still has room to grow. And it has grown.

From a share price of about $38 when I picked it in November, SolarEdge has tacked on another 38% worth of growth, rising to a recent price of $53 a share. But that naturally raises the question: Now that SolarEdge has grown so much (it’s more than tripled over the last year), does it still have room to grow more?

I think so. Priced at 29 times earnings today, SolarEdge looks significantly cheaper when valued on the earnings that really matter: its cash profits. SolarEdge generated $115 million in positive free cash flow over the last 12 months, 37% more than its $84 million in GAAP earnings would imply. Valued on that free cash flow, the company is selling for only 18 times cash profits, versus analysts’ long-term anticipated profits growth rate of 22%.

That’s a big discount to intrinsic value if SolarEdge can grow as analysts expect it to. So why might it? In a write-up in February, researchers at Vertical Group noted that SolarEdge’s competition in the market for solar inverters is “nowhere in sight.” Lacking competition, Vertical Group argued SolarEdge can essentially “dictate” the prices it charges for its products all the way “through 2018,” a prediction we’re seeing reflected in the company’s soaring profits.

I see a bright future for this solar power play still.

An incredible comeback

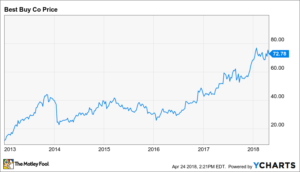

Tim Green (Best Buy): Shares of consumer electronics retailer Best Buy have doubled over the past three years. Going back further, the gains are even more impressive. Since the beginning of 2013, Best Buy stock has shot up more than 500%.

What happened? A well-executed turnaround focused on slashing unnecessary costs, lowering prices, growing the online business, and investing in the customer-facing workforce. Recent news that Best Buy had struck a partnership with Amazon to be the exclusive seller of smart TVs running Amazon’s Fire TV OS is all the proof you need that the company’s brick-and-mortar stores are valuable assets, not crippling liabilities, in the age of e-commerce.

Best Buy stock may not double again anytime soon, but it could keep moving higher. The company’s fourth-quarter results were nothing short of spectacular, with comparable sales rising 9% and adjusted EPS jumping 25%. Best Buy sees adjusted earnings per share rising as high as $5.75 by fiscal 2021, putting the P/E ratio based on that number at 12.7. Back out the net cash on the balance sheet, and that ratio falls to just 11.6.

Best Buy has figured out how to thrive despite the ongoing disruption in the retail industry. Even after the massive gains since the start of 2013, the stock still isn’t all that expensive. Don’t expect an encore performance (most of the gains are probably in the past). But Best Buy stock can keep grinding higher as long as the company’s strategy keeps working.

A game company with serious potential

Keith Noonan (Take-Two Interactive): Thanks largely to the historic success of its video game Grand Theft Auto V (GTA V), Take-Two Interactive’s stock has climbed roughly 100% since 2017 and more than 500% since 2013. As impressive as those returns have been, I think the company is in position to continue delighting shareholders and gamers alike.

Despite the fact that the first version of Grand Theft Auto V was released in 2013, last year was actually the game’s best sales year. That’s an unprecedented feat, and it looks like GTA V still has plenty of gas in the tank. Take-Two recently released a new, premium version of the title that comes with the digital currency used in the game’s online mode, and the package stands to be a significant sales hit. There’s also the possibility that GTA V will be released on Nintendo’s Switch console — a development that could add more than 10 million unit sales to the game’s already incredible run and be hugely profitable.

Take-Two also appears to be strengthening the rest of its franchise slate. NBA 2K18 is on track to be the company’s most successful sports game ever, Red Dead Redemption 2 is likely to be a big hit when it releases later this year, and reports suggest that new entries in the Borderlands and Bioshock series are in advanced stages of development. Outside of the traditional PC and console gaming space, Take-Two is also making a bigger push in mobile and exploring new opportunities in esports and virtual reality.

With the company’s product lineup looking better than ever, an expanding global market for video games, and emerging growth avenues that have a lot of untapped potential, I think Take-Two is a stock that still has room to run.