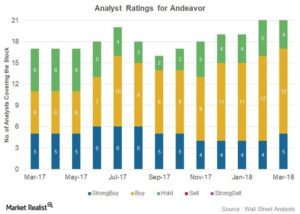

Analyst ratings for Andeavor

The analyst rating graph below shows that 17 (or 81%) of the 21 analysts covering Andeavor (ANDV) have rated it a “buy” in March 2018. Four analysts have rated it a “hold.” ANDV’s mean price target of $138 per share implies a 54% rise from its current level.

Peer ratings

ANDV’s peers Valero Energy (VLO), Phillips 66 (PSX), and Marathon Petroleum (MPC) have been rated a “buy” by 45%, 35%, and 75% of analysts, respectively. Smaller players Delek US Holdings (DK), PBF Energy (PBF), and HollyFrontier (HFC) have been rated a “buy” by 86%, 29%, and 26% of analysts, respectively.

Why the ‘buy’ ratings?

Andeavor continues to integrate Western Refining (WNR). Andeavor has achieved $190 million of synergies on an annual run-rate basis in 2017. The company expects annual synergies of $350 million–$425 million from the integration of WNR by June 2019.

Andeavor also plans to focus on the growth of its logistics segment. With that aim in mind, Andeavor agreed to acquire asphalt terminals from Delek US Holding (DK). That would take ANDV’s asphalt capacity to 430,000 tons across ten terminals. The acquisition is expected to close in 1Q18.

ANDV also plans to expand Andeavor Logistics (ANDX), its MLP. ANDV plans to transfer its newly acquired stake in Rangeland Energy II and its Permian logistics assets to ANDX. The integrated system, including ANDX’s Permian assets, is expected to see considerable expansion and rise in volume in the next few years. ANDV also dropped down Anacortes logistics assets to ANDX for $445 million in 4Q17.

Overall, Andeavor expects to incur capex (capital expenditure) of $1.5 billion in 2018, of which $1.1 billion is for Andeavor and $0.43 billion is for ANDX. ANDV’s acquisition and capex activities, which could result in higher future earnings, have likely led analysts to rate Andeavor a “buy.”

In the next part of this series, we’ll see how Andeavor’s debt position is shaping up.