What happened

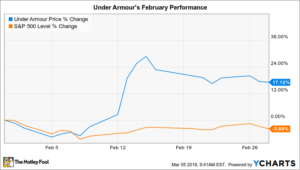

Sports apparel retailer Under Armour (NYSE: UA) (NYSE: UAA) outpaced the market last month, jumping 17% compared to a 4% decrease in the S&P 500, according to data provided by S&P Global Market Intelligence.

The surge helped chip away at shareholders’ losses, although the stock remains far below its all-time high and has shed over 60% since early 2016.

So what

Investors were happy with the fourth-quarter results that were issued in the middle of the month. In that report, the retailer announced declining profitability and weak sales growth. However, operating trends improved significantly from the prior quarter.

Sales fell by 4% in the core U.S. market, for example, compared to a 12% dive in the third quarter. Under Armour’s gross profit margin shrank by 1.5 percentage points, which represented a modest uptick from the prior quarter’s 1.6 percentage-point drop.

Now what

CEO Kevin Plank and his team are forecasting another transition year ahead, with sales growth sticking close to the 3% uptick they managed in 2017. Profitability should improve as the U.S. market continues to stabilize, and as Under Armour’s restructuring plan shaves costs.

From there, executives are hoping that their reduced expense burden will allow them to generate healthier profits in the core U.S. segment while they expand more aggressively in attractive international markets like China.